Background Screening - FAQ

Frequently Asked Questions about Background Screening & Other Reports

Background Screening - General Questions

-

How do I order a report with AAA Credit Screening Services?

If this is your first time ordering a report from AAA Credit Screening Services, you will first need to become a client by filling out our online Client Service Agreement. This form will let us know who you are, and what kind of reports you will be needing from us. Shortly afterward, you will be contacted by an AAA Credit Screening Services representative who will walk you through the process.

What information is needed from my applicant to run a credit report?

AAA Credit Screening requires the following information from the applicant to run a credit report for an existing client:

- Name

- Social Security Number

- Current U.S. or Canadian Address

- Signature Authorizing the release of the credit report

Can I run a background check on myself?

Unfortunately AAA Credit Screening Services can not run your background checks for personal use

How far back do credit reports go?

Credit history is reported for seven (7) years after the date of last activity on an account. This means that a credit card your applicant has had since 1988 will still show up on their credit report in 2017 if they made a purchase or payment on that card within the past seven (7) years, but a mortgage that was paid in full in May 2005 may not appear on the applicant’s credit report after June 2012.

What kind of criminal records will show up on my criminal report?

AAA Credit Screening Services will report all convictions within seven (7) years from the original date of criminal activity. AAA Credit Screening Services WILL NOT report the following criminal records:

- Any convictions older than seven (7) years from the original date of criminal activity

- Any deferred adjudication, adjudication withheld, or similar diversionary program dispositions

- Any pending or open cases

- Any dismissed cases

- Any cases in which the applicant cannot be matched to at least two (2) identifiers.

Furthermore, while AAA Credit Screening Services offers multiple types of criminal reports, the United States court system is made up of thousands of jurisdictions, many of whom do not report/are not required to report all criminal activity. It is possible, and/or likely, that some criminal activity may not be discovered.

What is the difference between a Federal Criminal Records and a National Criminal Records?

The difference between the Federal and National Criminal Record reports is where the search is conducted.

National Criminal Records include misdemeanors or felonies committed all over the country. The databases searched for our National Criminal Records include county courts, police records, state criminal records, and more.

Federal Criminal Records include crimes that were prosecuted in federal court, such as fraud, drug trafficking, money laundering and tax evasion. The databases searched for our Federal Criminal Reports are within the Federal Court System.

Does AAACSS offer batch ordering?

Yes! If you order a high volume of employment, tenant, or creditor-related consumer reports on a daily, weekly, monthly or even annual basis, batch ordering is available to existing customers through our online ordering system, to learn more about the process, click on BATCH ORDERING

Existing Client and Online Ordering

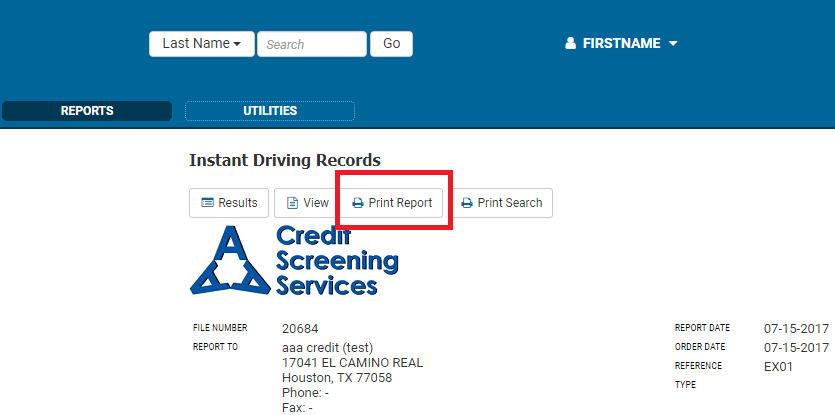

How do I print/save my report?

When you view your report in your online account, you can print the report or save as a PDF by clicking the “Print Report” button, seen here:

Help! My report still says “pending,” but I know some searches should already be complete.

While the entire report may still be labeled as “pending,” you can view the completed searches within the report at any time by logging in to your online account and clicking on the “Reports” tab, then clicking checkbox next to the name of the applicant whose report you wish to view, then clicking the “View Report” button.

How do I know when my report is done?

When your full report is done, you will receive an email notification with a link to the completed report. You can also view pending reports at any time by logging in to your online account and clicking on the “Reports” tab, then clicking checkbox next to the name of the applicant whose report you wish to view, then clicking the “View Report” button.

Employment Background Checks

What is an Employer Certification form?

An employer certification form is a document which is required to be submitted with all employment background check related requests. It must be signed and dated by you, our client. You can click on Employer Certificaton to read more about what the employer certification form is and why it must be completed.

Will my credit report include a credit score?

No, employment credit reports are different from other consumer credit reports in that they will not include a credit score.

If I want to run a background check on a volunteer, is it considered an employment background check?

Yes. All reports on current or potential volunteers are considered employment background checks; this means that all requests for screenings on volunteer workers will require the same authorization and certification forms as employment background checks.

Why does it take up to 3 days for employment verifications?

Employment verifications are done by phone, fax, or email and does require a response from current/previous employer. We will attempt to make contact to obtain information for at least 3 business days.

Are there any additional fees associated with the Employment Screening Packages?

Some of the reports included in the Employment Screening Packages, such as the county criminal reports, employment verifications, and education verifications, are subject to additional fees due to the associated institution’s use of third-party-verification services. In this case, an AAA Credit Screening representative will reach out to you immediately, requesting approval or denial for this additional fee. Your account will not be charged without your consent.

For more information, click on Employment Background Check

Tenant Screening

-

What is included in my credit report?

- Credit Score

- Credit Summary: Quick overview of accounts reflected in credit report

- Financial Summary: Quick overview of debt reflected in credit report

- Credit History: Detailed account information the credit bureau has on file for the subject’s credit

- Public Records: Bankruptcies, judgements, or tax liens (if applicable)

- Prior Inquiries: Member inquiry history

Click on TENANT CREDIT REPORT for a sample of a report. How do Landlord Verifications work? Is there a database that stores all the tenant’s previous rental history?

Unfortunately, no such database exists. To complete a Landlord Verification, AAA Credit Screening requires a contact name and phone number for the applicant’s current and/or previous landlord(s). AAA Credit Screening representatives will then reach out to the contact, verify their legitimacy, and proceed with the verification from there.

Can AAA Credit Screening Services run reports on commercial tenants?

Yes! AAA Credit Screening Services can run both individual credit reports on the principal(s) of the company, and business reports on the company itself. For more information click on Commercial Tenant Credit Report.

Can credit reports be ran on individuals who do not have a U.S. Address?

All credit reports require a United States address (current or previous) to be ran. The exception to this is Canadian credit reports. Canadian credit reports, run through the credit bureau Equifax, may utilize a Canadian address (including street address, city, and province) when reporting information about an applicant. While there is no price difference between a Canadian Credit Report and a U.S. Address, Equifax has additional restrictions placed on the report requestor, including a site visit, wherein a representative of Equifax inspects the property where you will be storing the report information. If you are interested in obtaining credit reports from Equifax, but have not had a site visit performed on your property, call our offices at 281-282-0447 for more information.

For more information, click on TENANT SCREENING

Business Credit Reports

What is the difference between a business credit report and a tenant or employment report?

Legally, the difference between a business credit report and a tenant or employment report is that business credit reports are not “consumer reports,” that is, they do not report information on individuals, therefore, they are not governed by the Fair Credit Reporting Act (FCRA).

Business reports will report minimal information on the business owner (primarily only their status as the owner, and any other additional principal(s) or key person(s) within the company). A business report’s focus is reporting information pertaining to the company. In the case of business credit reports, this includes information about that company’s commercial tradelines.Do business reports require the authorization of the company to run?

No. Unlike consumer reports, business reports can be ordered and completed without a consumer’s authorization.

What information should I provide when ordering a business report?

The following information is REQUIRED when ordering a business report:

- Business Name

- Business Address (Street address, City, State, Zip Code)

The following information is SUGGESTED when ordering a business report:

- Business Telephone Number

- BDA (if applicable)

- P.O.Box (if applicable)

What is the difference between a Business Summary, a Commercial Intelliscore, and a Business Profile?

The difference between a Business Summary, a Commercial Intelliscore, and a Business Profile lies primarily in the level of detail given in the report. The business summary provides a credit report and legal snapshot of the business, with no dollar figures. The Commercial Intelliscore provides the same credit report and legal snapshots, plus dollar amounts of the total tradelines developed and days beyond terms (DBT) that the company has gone past the payment due dates on their invoice agreements. The Business Profile provides all of this information, plus detailed tradeline and debt information, and detailed legal filing information.

Something unique to the Commercial Intelliscore is the Intelliscore Plus, a rating number similar to a credit score, which ranks the company against other businesses in the same industry, based on its tradeline information. This report is typically most suitable for clients who want a quick yes or no “at-a-glance.”-

What is a List of Similars? What do I do with this document that was emailed to me?

When AAA Credit Screening Services cannot find a business in Experian’s database with an exact match to the information given to us, or there are too many businesses with similar names and addresses to the company, we will send you a list of businesses with similar names and/or addresses. When you receive this document, please select one of the businesses listed or notify AAA Credit Screening Services if none of the businesses match the company that you are looking for. This can be done via email reply, fax, or phone call.

If none of the businesses on the List of Similars match the company you are looking for and there are no other DBAs that you wish for AAA Credit Screening to search for the company under, the price of your report will be lowered to a lesser search charge.

Why didn’t the company I ordered a screening on show up in the database? Does this mean that it is not a real business?

From time to time, businesses will not appear in Experian’s extensive database. This could be for one of a few reasons.

Firstly, the address you provided may not be the address that Experian has on file for this business. Try reaching out to your applicant and asking if there are any alternative addresses that the business has had in the past seven years.

Secondly, the business may be recorded in the database under a different name, such as a DBA. Be sure that you have provided any and all DBAs to AAA Credit Screening Services so all names can be searched.

Thirdly, the business may not have been established for a long enough time to have a credit record on Experian’s files. While the scope of businesses that are captured in our business credit reports is very wide, some businesses that were established in the past year may not have established credit history which has been reported to any credit bureau. In this case, an alternative report would be a business license search, along with an individual tenant credit report on the principal(s) of the company.

For more information, click on Business Credit Reports.

NEW Customer Signup

AAA Credit Screening Services charges NO Signup Fee, No Monthly Fees & No Annual fees! You only pay for the reports you want to order. Signup is 3 easy steps and once you're signed up, you can start ordering reports online. Click on the button below to complete our online Customer Service Agreement:

Customer Service

Call Us Monday-Friday from 8 AM - 5 PM CST

281-282-0447

Or contact us using the button below: